Financial Planning Strategies to Enhance Qualified Small Business Stock (QSBS)

QSBS is arguably the most attractive tax strategy available to entrepreneurs and business owners in the U.S., and the current environment may be the golden age for QSBS strategies. There are several personal financial planning strategies that can enhance or even multiply the Section 1202 QSBS benefit, which allows for a capital gain exclusion of $10 million, 10 times the investment basis, or thanks to the One Big Beautiful Bill Act (OBBBA) $15 million for shares issued after 7/4/25.

QSBS Requirements

Before diving into planning strategies, it is important to note the key requirements for QSBS treatment. To qualify for QSBS, shares should be original issue stock issued after 8/10/1993 directly from a domestic C corporation. Secondary market purchases don’t qualify. Efforts to circumvent the original issuance rules though redeeming existing shareholders and reissuing shares can jeopardize QSBS status as 1202 has specific prohibitions against company redemptions for this reason. Although shares received via gift, inheritance, or as a distribution from a partnership (i.e. a venture capital fund) are exceptions to the original issuance rule. Moreover, to meet QSBS requirements, at least 80% of the company’s assets should be used in a “qualified trade or business”, which excludes companies in the following industries:

Health, law, engineering, architecture, brokerage services

Banking, insurance, financing, leasing, investing, or similar

Farming

Oil and mining

Hotel, motel, restaurants

Any business whose principal asset is the reputation or skill of the employee

For founders and owners whose businesses include both qualified and non-qualified activities, it may be worthwhile to consider separating them into distinct entities for QSBS eligibility, particularly if there’s a strong likelihood the qualified activities will be sold in the future.

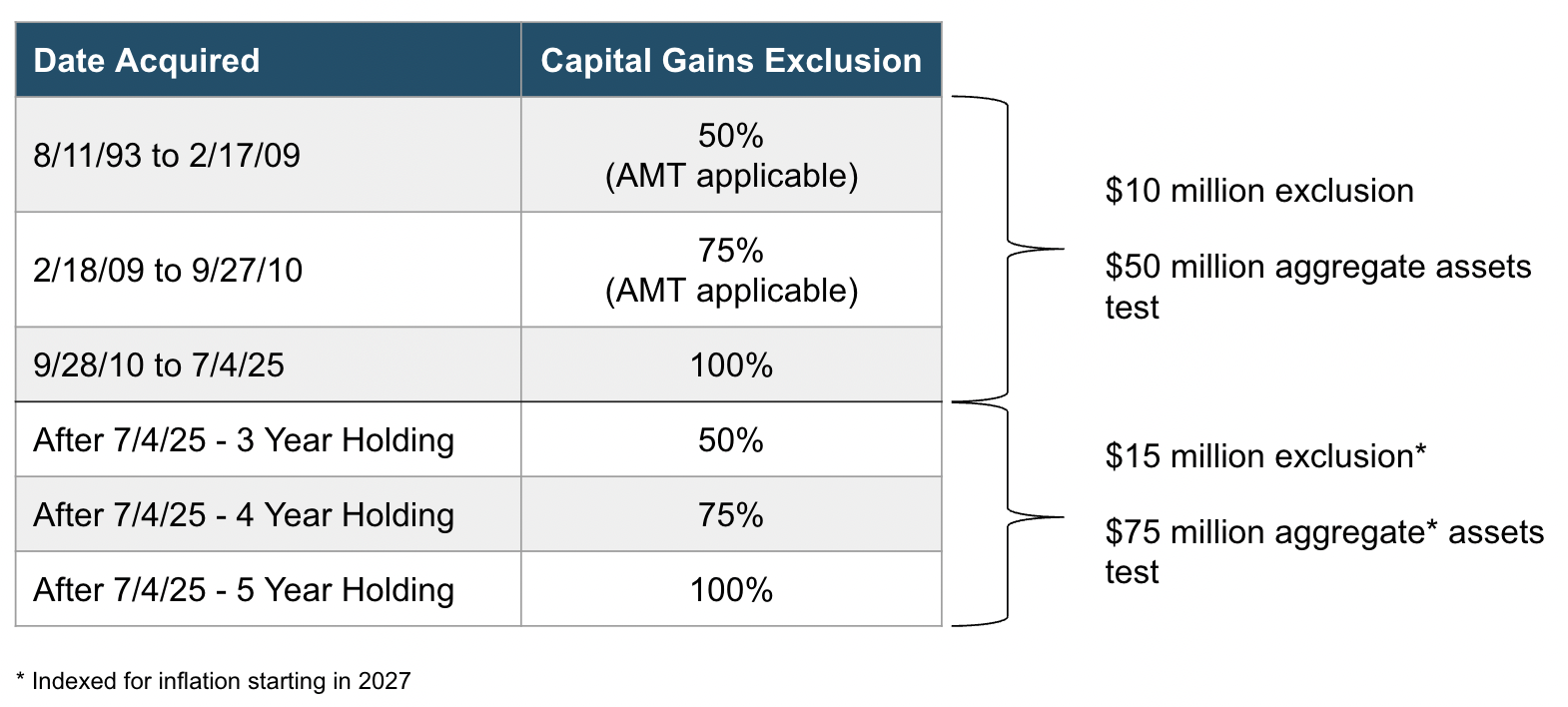

QSBS Benefits Vary Based on the Date of Issuance

The QSBS benefit depends on both the date the shares were issued and the length of time they are held. QSBS issued between 9/28/10 and 7/4/25 are eligible for the higher of a 10X basis or a $10 million exclusion after a 5-year holding period. Shares issued after 7/4/25 are eligible for a $15 million exclusion after a 5 year holding period, but are also eligible for partial benefits after 3-year or 4-year holding periods.

Prior to a liquidity event, entrepreneurs and business owners should carefully evaluate various strategies that may best suit their unique circumstances, both from a business and a personal perspective.

Conversions to C Corps

Owners of non-C Corp entities anticipating a large liquidity event may want to consider converting to a C Corp. Many business owners may prefer the pass-through deductions and flexible profit allocations of the LLC structure during the early years of a business. However, as the business builds momentum, a C Corp structure that is QSBS-eligible could be more attractive for a growing company that may be sold for a large capital gain.

For example, an LLC owner may convert to a C Corp, then start the clock on the 5-year holding period to garner the 10x basis or $15 million capital gain exclusion. Basis for QSBS utilizing a conversion is the fair market value of the shares at the time of conversion. This means that a wholly owned LLC valued at $8 million, with an actual cost basis of $1 million, would be eligible for a $80 million capital gain exclusion. This would be 10 times the $8 million value at conversion plus they would owe the original built in capital gain ($7 million) at the point of conversion.

Converting to a C Corp

When it comes to entity conversions or the formation of entities upfront, shareholders should keep in mind that not every state recognizes a QSBS capital gain exclusion. For example, New York state allows a capital gain exclusion, but California and New Jersey do not. And while converting to a C corporation may be beneficial in some cases, doing so in a state with high local taxes on the C Corp may reduce the appeal of the QSBS benefit.

Founders should work closely with their advisors to model out the pros and cons of each structure, considering not only the eventual exit strategy, but also annual taxes, double taxation issues, and other considerations.

If a conversion is deemed beneficial, founders should be mindful to avoid conversions when the company market value is above the $75 million (after 7/4/25) aggregate assets threshold post conversion. Additionally, obtaining a defensible valuation report is recommended for documentation purposes.

Alternatively, founders could time the conversion as outside investors put additional capital into the business with the term sheet serving as the valuation substantiation. It is also worth noting that converting from an S Corp to a C Corp to garner QSBS status often involves a several step F reorganization structure.

Balancing Attractive Offers Against QSBS Benefits

For some fast-growing QSBS businesses that have not yet met the holding period for the $10 million or $15 million gain exclusion, an early and unexpected liquidity event can raise important questions to consider: Is it better to take the money now and pay a higher current capital gain rate, or hold out on the liquidity event until a favorable tax situation? Will the company be more or less valuable when the QSBS becomes eligible for the capital gain exclusion? What will the merger and acquisition market look like in the future? Will tax laws be more or less favorable in the future? How challenging will it be to make the company more valuable between now and when you hit the 5-year holding period?

QSBS Example Breakeven Analysis

It’s also beneficial to run a breakeven analysis comparing the outcomes of selling now and reinvesting the proceeds versus waiting to sell after meeting the holding period. As an example, a company with a 3-year holding period could sell for $15 million today and net the same proceeds as a QSBS capital gain exclusion sale two years later with a $12.2 million price. However, selling two years earlier would allow reinvestment of the proceeds for a longer period of time. Given that the real breakeven sale price, accounting for the reinvestment of the sale proceeds for two years at 8%, would only be $14.7 million.

It is important to note that buyers often prefer asset sales over stock sales for a variety of reasons (e.g. limits their liability, offers asset depreciation benefits, etc.). As a result of this preference, an asset sale could mostly nullify the benefits of QSBS enhancement strategies. Different types of buyers have different types of structuring preferences and it’s important to keep those preferences in mind as founders ponder different strategies to enhance their QSBS benefit. Buyers may even use the QSBS exclusion as a bargaining chip to garner a lower purchase price. If an asset sale is transacted, C corp shareholders may still benefit from QSBS in the distribution from the C corp’s liquidation.

The 2025 OBBBA has made liquidity events before the 5-year holding period more attractive. Now QSBS sold after 3 years can garner a 50% exclusion and shares sold after 4 years can benefit from a 75% exclusion. The flip side is that the non excluded portion of the gain is subject to a higher 28% capital gains rate. For example, a company sold for $20 million after 3 years, would have $7.5 million excluded from capital gains, $7.5 million subject to 28% capital gains and 3.8% NIIT, and $5 million subject to a 23.8% capital gains rate.

Strategically Exercising Stock Options

All QSBS holders are subject to a 5-year holding period requirement that starts when the taxpayer receives the original issue stock. It is for this reason, starting the clock on the holding period can be an important consideration.

To further complicate the process, when a founder, employee, or contractor receives stock option grants, whether it’s incentive stocks options (ISOs) or nonqualified stock options (NSOs), the holding period doesn’t begin until the options are actually exercised and the stock is received.

Holders often face a difficult decision balancing the potential QSBS benefits of early exercise versus the actual costs to exercising the options. Option holders would not only need to cover the cost of exercising their options, but may also face a substantial tax liability if the company's 409A valuation exceeds the option strike price.

For ISOs, one strategy is to run tax projections toward the end of the year and exercise only enough options to stay below the threshold that triggers the alternative minimum tax (AMT). As background, AMT is triggered when the fair market value of exercised shares exceeds the ISO strike price, so it then counts as income for AMT calculation purposes. If your AMT exceeds your standard tax calculation in a given year, you will pay additional taxes that year but receive an AMT credit as well. You get to use this credit in future years where your standard tax exceeds your AMT.

Laddered QSBS Holding Periods

The option holder could repeat this process each year, executing only enough options to optimize their finances based on the combination of the amount of liquidity they have, minimization of AMT, and the probability and magnitude of an expected liquidity event. The option-holder essentially ends up with a laddered holding period with this strategy. Over time the option-holder can end up diversified between the most likely outcomes: a liquidity event with a QSBS exclusion, a liquidity event without a QSBS exclusions, no liquidity event with money wasted exercising options, and no liquidity event with options unexercised.

One common mistake option holders make is not exercising options before the $50 million or $75 million aggregate assets threshold is crossed. Option holders should be coordinating with the company CFO to understand and document the timing of when the company may cross this threshold.

Given the benefits of QSBS, option holders should carefully evaluate the advantages and disadvantages of exercising their options early to start the 5-year holding period as soon as possible.

Security Type and QSBS Holding Periods

There are many different types of hybrid securities founders may receive, and founders should speak with their tax advisors regarding when their holding period begins for purposes of the 5-year rule and the $50/$75 million aggregate gross assets test. When it comes to convertible debt, many people believe the holding period begins when it is converted to stock. On the other hand, non-voting stock and preferred stock stocks the QSBS holding period when issued to the shareholder. Warrants likely begin their holding period when they are also exercised into stock. Phantom stock isn’t really stock at all, so it wouldn’t qualify as QSBS. There’s no definitive guidance on whether being issued a SAFE (Simple Agreement for Future Equity) starts the QSBS holding period.

Section 1045 Rollovers

IRC Section 1045 allows QSBS holders other planning opportunities to minimize their tax liability. For instance, if a shareholder has held QSBS stock for more than six months but has not yet met the 5-year holding period requirement at the time of a sale, they can reinvest the sale proceeds into another QSBS-eligible company through a Section 1045 rollover. By doing so, the shareholder can meet the 5-year QSBS requirement and benefit from the $10 million capital gain exclusion upon the sale of the second company. One caveat here is that the rollover must occur within 60 days of the sale.

Founders can also roll over gains above the $10 million QSBS exclusion into new shares, allowing them to potentially exclude additional capital gains. As well, if the rollover is into multiple companies, then the shareholder would receive a new $10 million exclusion for each new company.

Given the tight timeline on the reinvestment, it can be problematic to time the sale of the first company and quickly identify and perform due diligence on the second company. One option could be to establish a new C Corporation into which the sale proceeds can be rolled into as startup capital. However, this can also be challenging given the need to align the formation of a bona fide new venture with the timing of the liquidity event. Moreover, the liquidity event could be a secondary sale of only a portion of a founder’s shares, so it would be exceedingly difficult to start the new C corp while still at the original startup. In situations where a QSBS company has gone public and the lockup period is over, a 1045 rollover may be attractive since sales can be timed with greater flexibility in the public markets.

The attractive capital gain exclusion for QSBS can often be maintained when a company is purchased for new equity in the acquiring company. If a QSBS holder receives new non-QSBS shares from an acquisition after only a 3-year holding period, then the $10 million exclusion is maintained within the new shares. That said, any subsequent growth in the new shares wouldn’t qualify for QSBS.

Alternatives to Section 1045 with Gains in Excess of the Exclusion

When a founder has a gain in excess of $10 million or $15 million exclusion, rolling over the taxable portion of the gain through a 1045 rollover or paying the capital gain taxes aren’t the only options. Founders can use the opportunity zone program for powerful tax benefits by rolling over taxable gains into a real estate investment starting in 2027. Benefits include a 5-year tax deferral on the taxable portion of their gain, a 10% or 30% reduction in the gain if held for 5 years, and tax-free status for future gains on the investment property if it’s held for 10 years.

Another strategy could be combining an QSBS share sale up to the exclusion amount and then selling another portion to an employee stock ownership plan (ESOP). ESOPs allow a tax deferral on the sale proceeds from an C corp through 1042 rollover if proceeds are reinvested in qualified replacement property (QRP), such as US stocks and bonds. However, ESOP have very specific criteria, and the structure isn’t typically appropriate for fast growing VC-based tech companies. There are a myriad of other capital gain mitigation strategies including installment sales, custom index tax-loss harvesting, residency planning, as well as ordinary income reducing strategies that indirectly reduce capital gains like cash balance plans, real estate investing, oil and gain investing, and charitable giving strategies.

QSBS Stacking Strategy

A unique feature of QSBS is that the $10 million capital gain exclusion is per tax payer. When a QSBS holder transfers some of their shares to another person or trust, the recipient becomes eligible for their own separate $10 million capital gain exclusion. The recipient also inherits the original holder’s holding period.

As an example, if a shareholder is issued QSBS on 1/1/20 and three years later their child inherits the stock, they will inherit the original holding period as well. Further, if the inherited stock is sold three years later on 1/1/26, then they would be eligible for the $10 million capital gain exclusion. Although, the QSBS may not be that beneficial if there isn’t much appreciation after the inheritance, since the basis would have received a step-up in basis to market value on the date of death.

Combining the separate tax payer feature and holding period carryover features of QSBS can be lucrative through “stacking”. For instance, a QSBS holder may have $20 million in stock eligible for a $15 million capital gain exclusion. If that stockholder were to give 25% of their shares to a child (or a non-grantor trust with the child as beneficiary), 25% to another child, and 25% to their parent, then each of the recipients would have $5.0 million of stock and a $15 million capital gain exclusion. Collectively, they would have a capital gain exclusion of $60 million if the company had a liquidity event. Gifting to non-grantor trusts can work as well, since they are a separate taxpayer for QSBS purposes.

QSBS Stacking Pitfalls

Founders should work with their CPA, financial planner, and other advisors when implementing the stacking strategy with non-grantor trusts to avoid running afoul of IRS rules on multiple trusts. Section 643(f) indicates that multiple trusts may be treated as a single trust if the grantor and beneficiaries are substantially the same and the primary purpose of establishing the trusts is deemed to be tax avoidance. In other words, setting up ten trusts to get $150 million of capital gains exclusion for three children isn’t likely to pass muster. When setting up multiple non-grantor trusts, perhaps it makes sense to use a variety of trustees, vary the trust distribution provisions among the various trusts, and also document non-tax reasons for the trusts to minimize the risk that the trusts would be collapsed into one. Though the most conservative approach would be to have no overlapping beneficiaries.

Founders should tread carefully when using non-grantor trusts for the stacking strategy. There are many document provisions that can inadvertently make a would-be non-grantor trust into a grantor trust. Grantor trust status would prevent a successful QSBS stacking strategy. Moreover, if the original shareholder retains voting rights of shares gifted to a non-grantor trust, it’s possible that could disqualify the non-grantor status of the trust. Having the trustee maintain control over voting rights would minimize this risk.

While trusts provide enhanced asset protection and greater control on distributions, founders should think through the pros and cons of direct gifting or QSBS stacking through trust structures. Trusts have additional ongoing costs, administrative requirements, and potentially higher compressed tax rates on the reinvestment.

QSBS Stacking and the Lifetime Exemption

Those considering the stacking strategy should keep the lifetime gift exemption in mind. While the exemption is set at $13.99 million in 2025 and increasing to $15 million in 2026 due to the OBBBA, the exemption could decrease in the future with changes in legislation. In an effort to lower future potential capital gains, an entrepreneur may find themselves in a situation where they end up paying current gift tax by exceeding the lifetime exemption.

The timing of gifts should also be carefully considered. In the case where the company is worth more over time, early gifts can use less of one’s lifetime gift exemption. Given the cost and administrative hassle of implementing trust gifts, many shareholders opt to make these gifts close to a sale. However, if a sale is too close to the timing of the gift, the IRS may argue the “assignment of income” doctrine and potentially disallow the gift. If transfers are made close the an actual sale, it makes sense to meticulously document the unresolved deal issues at that point.

Stacking strategies can be combined with other effective financial planning strategies to help minimize potential tax liability. The founder may want to consider gifting sharing to non-grantor trusts in tax-free states to avoid state taxes on the sale and/or reinvestment. Moreover, stacking gifts of minority interests can benefit from valuation discounts to minimize the use of the lifetime gift tax exemption.

QSBS Packing Strategy

Another strategy to potentially reduce future capital gains and increase one’s basis is to contribute cash or property in exchange for shares. The increase in basis would reflect the market value of the property or cash contributed on the date of contribution. Contributing $2 million of property would then allow a capital gain exclusion of $20 million given the higher of 10X basis or $10 million rule. However, these new shares would be subject to a new holding period to satisfy the 5-year requirement, and shareholders should be mindful of the $50 million and $75 million aggregate assets limitations post issuance of these shares.

Multiple Tranches and QSBS Packing

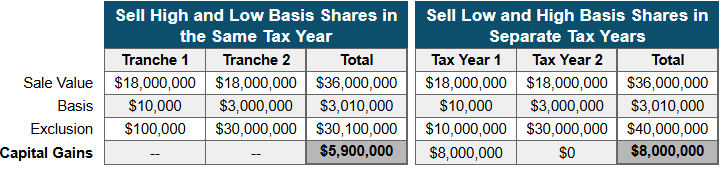

Another way to effectively use the “packing” QSBS strategy is to sell both high and low basis tranches of stock in the same year. For example, a founder could sell $36 million worth of shares in two equally valued tranches. One tranche of $18 million was purchased for $10,000 and eligible for a $10 million capital gain exclusion. The second tranche was purchased by exercising stock options for $3 million. The basis for both tranches is $3,010,000, so the capital gain exclusion is $30,100,000. By utilizing this strategy, the capital gains would be $5,900,000.

QSBS Packing Strategy Example

Alternatively, if the shares were sold in different tax years, capital gains would be assessed on the first tranche in tax year 1 ($18,000,000 minus $10,000,000) and $0 for the second tranche.

That said, there are instances where selling shares across different tax years may result in greater after-tax proceeds than selling all the shares in a single year. If a founder holds multiple tranches of QSBS, they should evaluate the tax and financial implications of various selling strategies. These may include selling all shares in a single tax year, selling high-basis tranches first followed by low-basis tranches, or starting with low-basis tranches before selling high-basis ones.

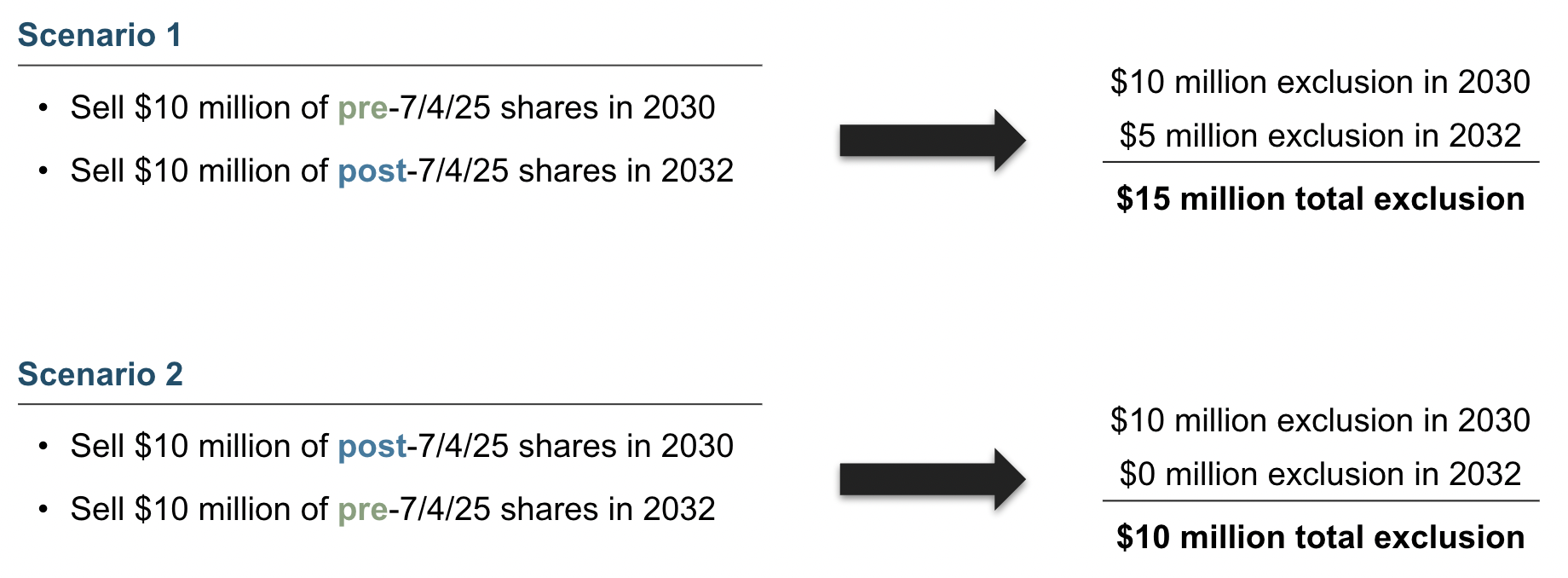

Maximizing the Exclusion with Pre-7/4/25 and Post-7/4/25 Shares

As secondary sales become more common in VC funding rounds, founders need to carefully consider which tranches of shares they sell. The $10 million exclusion applies to shares issued before July 4, 2025, while a $15 million exclusion applies to shares issued after that date. Selling in the wrong order could mean missing out on the larger exclusion. For example, imagine a founder received half their shares on August 1, 2024, and the other half on August 1, 2025. If they sell $10 million of post-July 4, 2025 shares in 2030 and then $10 million of pre-July 4, 2025 shares in 2032, they only receive a $10 million exclusion. But if they sell the pre-July 4, 2025 shares first, they could take advantage of the $15 million exclusion instead.

Increased QSBS Opportunities from OBBBA and the Aggregate Assets Test

For founders of companies modestly above the $50 million aggregate asset threshold, one potential planning strategy is to explore the new, more flexible research and development expensing rules under Section 174A. Because the OBBBA allows companies to amend returns from 2022 to 2024 to include these expenses, some businesses that were previously over the $50 million threshold could fall below it after making the amendments. This could mean non-QSBS eligible shares could be eligible for QSBS status.

Moreover, since startups can now expense R&D more freely, QSBS-eligible companies may be able to maintain their eligibility for a longer period. For example, a company that raised $70 million on September 1, 2025, could initially raise just under $5 million more and remain QSBS eligible. However, if the company then incurs $30 million in R&D expenses, it could raise nearly an additional $35 million, and those new shares would qualify for QSBS. Founders should be mindful of their current gross assets as they raise capital, so that they don’t miss out on opportunities.

Partnership QSBS Issues

One exception to the QSBS original issuance requirement is that when a partnership distributes QSBS to an individual partner, the shares generally retain their QSBS status. However, any distributions exceeding the partner’s ownership interest do not qualify for the exclusion. It’s also important to note that S Corporations cannot distribute QSBS to their shareholders. As a result, many investors hold QSBS through venture capital funds. To qualify, a venture fund’s limited partner (LP) must have been an LP both when the fund acquired and when it sold the QSBS shares. For example, in the adjacent chart, a VC fund invests in startups A and B at the beginning of years 1 and 2, respectively. However, the limited partner (LP) does not subscribe to the fund until the end of year 1. When startups A and B have liquidity events in years 6 and 7, meeting the five-year holding period requirement, the LP would be eligible for a QSBS exclusion on Investment B but not Investment A, since they were not an investor in the fund when Investment A was made.

Watch out for Venture Capital Fund Warehousing and QSBS

Venture capital funds often invest in startups before the fund officially launches, and then transfer those investments into the fund shortly after launch. While this can help with fundraising, it can jeopardize QSBS eligibility because of the original issuance requirement. To preserve QSBS benefits, it’s generally best for investors to join a fund that avoids warehousing investments before their LP capital is contributed.

Maximize QSBS as a Venture Capital LP

When considering investing in a venture capital fund, it makes sense to understand whether the strategy optimizes for QSBS. For example, are there many overseas venture investments? Non-domestic C corps are not QSBS eligible. Will there be warehoused transactions transferred into the fund? Warehoused investments aren’t QSBS eligible either. As well, it can be extremely helpful to LPs if the fund provides documentation and details on QSBS eligible after liquidity events.

Contributing QSBS to a Partnership for Estate Tax Planning

Founders should be careful with any transfer of their shares, since there could be negative consequences in certain situations. It’s a common estate planning strategy for wealthy families transferring assets to the next generation to contribute assets to family limited partnerships (FLPs) or family LLCs. Interests in these entities gifted to the next generation qualify for marketability and minority interest discounts, which lowers the value of the gift, and effectively saves on potential gift and estate taxes. Contributing QSBS into a partnership like this would disallow the exclusion.

Section 1244 as a QSBS Backup Plan

Of course, not every startup will have a liquidity event, which would render most QSBS planning useless. For startup shares that end up being a loss for founders, Section 1244, under certain circumstances, can allow this loss to offset ordinary income ($50K for single or $100K for MFJ) instead of being a capital loss. Losses in excess of the limits are treated as capital losses, so they can only offset capital gains or up to $3,000 of ordinary income per year. It could take many years to get the tax benefit of these losses without 1244. The 1244 strategy likely applies to only the earliest of founders or very small startups, since one of the requirements for 1244 is that aggregate capital cannot exceed $1 million when the stock is issued.

One planning idea is to structure loss sales over time so that the losses could be used against ordinary income in multiple years. Consider a founder in the 37% tax bracket with $200K of potential losses. If they took those losses in one year, they would benefit $50,700 from saving $100K at 37% and $100K at capital gain rates of 23.8%. On the other hand, if they took $100K of 1244 losses in separate years, they would save $74K.

Qualitative Benefits of QSBS for Founders

While many founders are aware of many of the benefits of QSBS, other stakeholders may be oblivious to QSBS benefits. Startups can often benefit by communicating the benefits of QSBS to current employees to boost morale, increase productivity, and encourage retention. As well, communicating the benefits of QSBS when pitching potential angel investors or recruiting potential talent can lead to better outcomes.

Other Common QSBS Pitfalls

As founders and shareholders explore strategies to enhance or maximize the benefits of their QSBS, they should be aware of the following potential pitfalls:

Short positions aren’t allowed on QSBS stock, so post-IPO QSBS holders should generally avoid hedging strategies. A loan against QSBS likely isn’t a short position, but founders should probably discuss possible transactions like this with their tax advisers before proceeding.

When founders fail to promptly take the 83(b) election within 30 days of issuing their founder shares, it could be detrimental to their financial planning in a few ways. As background, the 83(b) election allows founders to pay taxes on the issuance of their shares before they are even fully vested. Since the value of the company is likely to grow over time, they’ll pay taxes on a valuation amount significantly lower than in the future. Moreover, taking the 83(b) election early starts the holding period clock for QSBS purposes. Thankfully, it’s now common for many law firms to facilitate filing the 83(b) when preparing formation documents, but there are still situations were this important step can fall through the cracks.

Heirs to a QSBS holder receive a step-up in the cost basis of shares to market value at the time of death, although this new basis is not the basis used for determining the exclusion based on 10X basis. For example, if a founder paid $2 million for their shares and passed away when the shares were worth $7 million, the inherited shares would qualify for a $20 million exclusion (10X $2 million) not a $70 million exclusion.

Documentation is key for QSBS. It is advised to carefully track the holding period for shares, thoroughly document purchases, gifts, and additional contributions, and consider requesting certification of QSBS status from the company's CFO. If your startup is using Carta as for cap table management, their QSBS attestation letter service could be helpful for founders, employees, and investors alike. In certain situations it may make sense to get an QSBS opinion letter from a tax attorney.

Account for QSBS on your taxes correctly - the sale of QSBS goes on Form 1040, Schedule D and the gain exclusion is reported on Form 8949.

Founders should coordinate with their team to ensure that no business activities compromise the QSBS status. Having too many passive company investments, surplus working capital, or too much non-qualifying real estate can pose risks. Therefore, it is important to analyze the pros and cons, and alternative strategies carefully.

For example, it might make sense to lease instead of owning real estate in the business.

Proceed with caution in areas where the rules are unclear. Some would argue that strategies such as incomplete non-grantor trusts (ING) and charitable remainder trusts can bring added tax mitigation. However, it’s possible that there could be challenges at the state level or from the IRS on these structures.

As previously mentioned, we believe this the golden age for QSBS benefits. The current C Corporation tax rate, established by the 2017 Tax Cuts and Jobs Act (TCJA), stands at a historically low 21% and could potentially decrease further depending on future actions by the current administration.

With the number of strategies available for QSBS, we believe founders and shareholders should carefully evaluate their options to potentially maximize this benefit.

FAQs

Does my QSBS holding period start when I receive my SAFE?

SAFE (simple agreement for future equity) terms vary and it can be unclear whether the holding period begins when a SAFE is issued. Most SAFEs include language that parties agree that the SAFE is equity for purposes of Section 1202, but just because parties agree doesn’t mean the IRS would also agree. Many people would argue that since SAFEs are the predominant way of investing in startups and most investors are not given another alternative structure to invest in startups, then they should be considered equity. Others argue that since most SAFE terms don’t include potential dividends and voting rights, then they are more likely considered pre-paid forward contracts than equity.

When does the holding period begin on my company stock options for QSBS purposes?

The holding period for QSBS purposes on a stock option begins when the stock option is exercised. Since there could be tax consequences when executing options, it’s important to balance the QSBS benefits with liquidity needs and other tax considerations.

Do preferred stock and non-voting stock qualify for QSBS?

Assuming all the other qualifications are met, preferred stock and non-voting stock qualify for QSBS.

Is there a way to avoid paying taxes on my gain above the exclusion?

If the gain above the exclusion is rolled over using section 1045 into a new C Corp meeting the QSBS requirements, then those proceeds could qualify for a new QSBS exclusion.

I purchased my shares of a startup from the founder, can I still get QSBS if I hold the shares for 5 years?

Unfortunately not, to qualify for QSBS status, the shares have to be original issuance stock and can’t be received in a secondary transaction. There are some exceptions including shares received from inheritance, gift, or a distribution from a partnership that received original issued stock.

My startup is not a C corp, is it still possible for me to get a QSBS capital gain exclusion?

It still may be possible to get a QSBS exclusion if your company didn’t start out as a C Corp. It’s possible for a LLC or S Corp to convert or restructure their business into a C corp to be eligible for a QSBS exclusion in the future. However, for purposes of meeting the QSBS 5-year holding period, the clock starts on the conversion/restructuring date and not the original formation date of the LLC or S Corp.

With the new tax bill, can I get a partial exclusion if I sell my stock and I’ve held my stock for three years?

Only shares issued after the passage of OBBBA can bet the new partial capital gain exclusion after three (50%) or four years (75%). Shares issued before the passage of OBBBA are not eligible for this benefit.

I have an offer to buy my company as an “asset sale” not a “stock sale”, do I still get an exclusion on the sale proceeds?

The liquidity event has to be a stock sale to receive the benefits of QSBS.

How can I increase my exclusion by “packing” more basis into my startup?

Since the QSBS exclusion is the higher of 10X your tax basis or $10 million (or $15 million for post-OBBBA shares), it may be possible to contribute new funds into your startup and the newly issued shares would have a basis that gives you a higher QSBS exclusion. For example, buying additional shares for $2 million would give you a $20 million exclusion.

What are other ways I can get a larger QSBS exclusion?

Some founders implement QSBS “stacking” to multiply their QSBS exclusion. This involves gifting shares to other individuals or non-grantor trusts, since the recipient of a gift receives a new QSBS exclusion and carries on the holding period of the donor. For example, if a founder gifts shares to a friend, a non-grantor trust for their parents, and a non-grantor trust for their children, then collectively they would have four possible QSBS exclusions instead of one.

If I have both pre-OBBBA and post-OBBBA shares, do I get a $10 million exclusion or $15 million exclusion?

This depends on different factors including the total size of your gain, whether you sell your shares all at the same time, the order in which you sell the shares if the shares are sold in different years, the basis of the shares, and other factors. For example, you could sell both tranches at the same time, then those would likely qualify for a $15 million exclusion. On the other hand, if you sold post-OBBBA for a $10 million gain in one year and then sold pre-OBBBA for another $10 million gain in another year, your total exclusion would likely be $10 million

Are shares issued when aggregate assets were over $50 million and under $75 million now eligible for QSBS?

Final regulations related to the new QSBS rules under OBBBA have not been released, so we don’t have definitive guidance on situations like this. However, it’s conceivable that a company in this type of situation might be able to qualify for additional R&D expenses decreasing assets below the $50 million threshold by amending previously filed corporate returns. Overall, we think it’s unlikely that pre-OBBBA shares issued between $50 million and $75 million of aggregate assets would now be QSBS eligible.

As an investor in a venture capital fund, will I be eligible for a QSBS exclusion if there’s a liquidity event for a company in the fund?

If you were a fund investor at the time of the investment into the company and at the time of the liquidity event, and other QSBS requirements are met, it’s likely that your portion of the liquidity event is eligible for a QSBS exclusion.

As an investor in a venture capital fund, how will I know which investments are QSBS eligible?

It’s important to have due diligence conversations with the fund managers ahead of a potential investment to understand if QSBS eligibility is a priority in their capital allocation strategy and what sort of QSBS documentation they will provide if there is a liquidity event. For example, if investments are targeted toward smaller companies, domestic C corps, non-service businesses, etc, then it’s more likely that positions will be QSBS eligible.

Can I put QSBS into a family limited partnership (FLP) so that I can use less of my lifetime gift exemption through marketability and minority interest discounts?

Contributing QSBS to a partnership like FLP will make those shares ineligible for the QSBS capital gain exclusion.

Can I use Section 1244 to have my loss offset ordinary income if my startup doesn’t work out?

Yes, up to $100,000 (MFJ) capital losses can be used to offset ordinary income instead of using those losses to offset capital gains and/or ordinary income up to $3,000 per year. Also, the capitalization would have had to be less than $1 million when those shares were issued.

David Flores Wilson, CFP®, CFA, CM&AA, CEPA is a New York City-based CERTIFIED FINANCIAL PLANNER™ Practitioner & Managing Partner at Sincerus Advisory. Click here to schedule a time to speak with us.

The information provided through this communication is intended solely for the general knowledge of visitors and does not constitute an offer or a solicitation of an offer for the purchase or sale of any security.